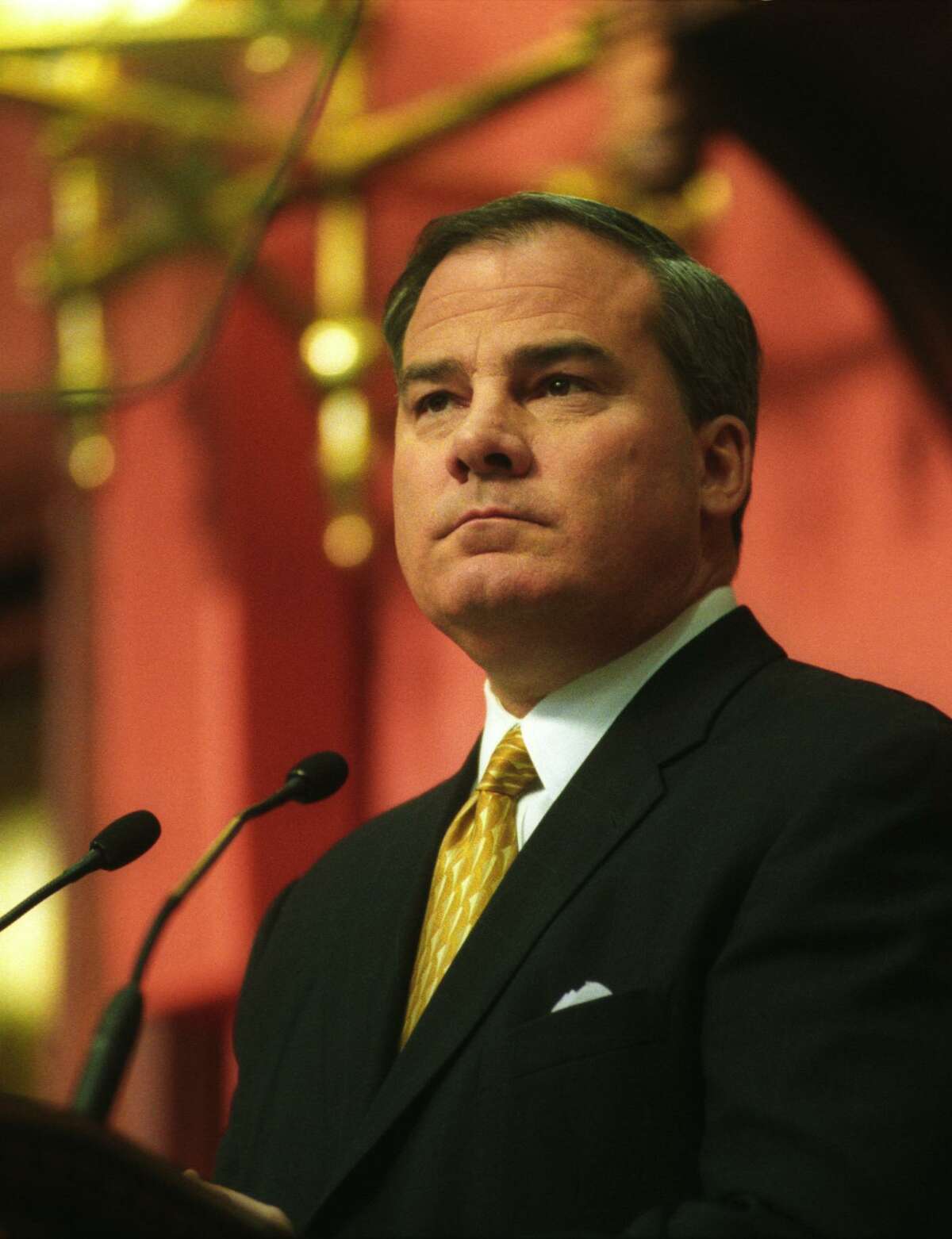

John Rowland net worth refers to the total value of all of John Rowland's assets and liabilities. This includes his cash, investments, property, and any other valuable assets. It also includes his debts, such as mortgages, loans, and credit card balances.

John Rowland's net worth is estimated to be around $1 million. This is based on his reported income, assets, and liabilities. It is important to note that this is just an estimate, and his actual net worth may be different.

Having a high net worth can provide a number of benefits, including financial security, access to credit, and the ability to invest in new opportunities. It can also be a sign of success and accomplishment.

- Paul Hollywood Wife

- Mick Jagger Net Worth

- Uncover The Enigmatic Life Of Leena Gianni Infantinos Wife

- Tom Welling Young

- Uncover The Truth The Ultimate Guide To The Oakley Rae Leaked Onlyfans Controversy

There are a number of factors that can affect John Rowland's net worth, including his income, spending habits, and investment decisions. It is important to note that his net worth can fluctuate over time, depending on these factors.

John Rowland net worth

John Rowland's net worth is a reflection of his financial success and wealth. It is calculated by adding up all of his assets and subtracting all of his liabilities. His net worth is estimated to be around $1 million.

- Assets: John Rowland's assets include his cash, investments, property, and any other valuable assets.

- Liabilities: John Rowland's liabilities include his debts, such as mortgages, loans, and credit card balances.

- Income: John Rowland's income is the money he earns from his job or other sources.

- Spending habits: John Rowland's spending habits can affect his net worth by increasing or decreasing his assets or liabilities.

- Investment decisions: John Rowland's investment decisions can affect his net worth by increasing or decreasing the value of his assets.

- Financial security: Having a high net worth can provide financial security by providing a buffer against unexpected expenses or financial emergencies.

- Access to credit: A high net worth can give John Rowland access to more favorable credit terms, such as lower interest rates and higher credit limits.

- Investment opportunities: A high net worth can allow John Rowland to invest in new opportunities that may have higher potential returns.

- Sign of success: A high net worth can be a sign of success and accomplishment.

- Fluctuating: John Rowland's net worth can fluctuate over time, depending on factors such as his income, spending habits, and investment decisions.

In conclusion, John Rowland's net worth is a reflection of his financial success and wealth. It is important to note that his net worth can fluctuate over time, depending on a number of factors. By understanding the key aspects of net worth, John Rowland can make informed decisions about how to manage his finances and increase his net worth over time.

- Dc Young Fly

- Unveiling Rebecca Blacks Ethnicity Discoveries And Insights

- Unveiling Guaynaas Net Worth In 2024 A Journey To Success

- Shaquille Oneal Wife

- Unravel The Secrets Discover The Zodiac Signs Prone To Ultimatums

| Name | Occupation | Net worth |

|---|---|---|

| John Rowland | Politician | $1 million |

Assets

Assets are an important part of John Rowland's net worth. Assets are anything that has value and can be converted into cash. This includes cash, investments, property, and any other valuable assets.

- Cash: Cash is the most liquid asset and can be easily converted into other assets. John Rowland may keep cash in a checking account, savings account, or money market account.

- Investments: Investments are assets that are expected to increase in value over time. John Rowland may invest in stocks, bonds, mutual funds, or real estate.

- Property: Property is land and the buildings on it. John Rowland may own a home, rental property, or commercial property.

- Other valuable assets: John Rowland may also own other valuable assets, such as jewelry, art, or collectibles.

The value of John Rowland's assets is constantly changing. The stock market can fluctuate, property values can rise or fall, and the value of other valuable assets can also change over time. As a result, John Rowland's net worth can also fluctuate.

Liabilities

Liabilities are an important part of John Rowland's net worth. Liabilities are anything that reduces John Rowland's net worth, such as debts, mortgages, loans, and credit card balances.

When John Rowland has a liability, he owes money to someone else. This can reduce his net worth by the amount of money he owes. For example, if John Rowland has a mortgage of $100,000, this will reduce his net worth by $100,000.

It is important for John Rowland to manage his liabilities carefully. If he has too much debt, it can be difficult to make payments and he may default on his loans. This can damage his credit score and make it difficult to get loans in the future.

John Rowland can reduce his liabilities by paying down his debts, increasing his income, or selling assets. By managing his liabilities carefully, John Rowland can improve his net worth and financial health.

Income

John Rowland's income is an important part of his net worth. Income is the money that John Rowland earns from his job or other sources, such as investments or royalties. It is the primary way that John Rowland increases his net worth.

Without income, John Rowland would not be able to pay his expenses or invest in assets. As a result, his net worth would decline. Therefore, it is important for John Rowland to maintain a steady income in order to increase his net worth.

There are a number of ways that John Rowland can increase his income. He can get a raise at his job, start a side hustle, or invest in income-generating assets. By increasing his income, John Rowland can increase his net worth and improve his financial health.

Spending habits

John Rowland's spending habits play a significant role in determining his net worth. When John Rowland spends money, he is either increasing his liabilities (e.g., by taking on debt) or decreasing his assets (e.g., by buying a depreciating asset). Conversely, when John Rowland saves money, he is either decreasing his liabilities (e.g., by paying down debt) or increasing his assets (e.g., by investing in an appreciating asset).

For example, if John Rowland buys a new car, he is increasing his liabilities by taking on debt. This will reduce his net worth by the amount of the loan. However, if John Rowland invests in a rental property, he is increasing his assets. This will increase his net worth by the value of the property.

It is important for John Rowland to be mindful of his spending habits and how they affect his net worth. By making smart spending decisions, John Rowland can increase his net worth and improve his financial health.

Investment decisions

Investment decisions are an important part of managing John Rowland's net worth. When John Rowland invests, he is using his money to buy assets that he believes will increase in value over time. If his investments perform well, his net worth will increase. However, if his investments perform poorly, his net worth will decrease.

For example, if John Rowland invests in a stock that goes up in value, his net worth will increase by the amount of the gain. However, if John Rowland invests in a stock that goes down in value, his net worth will decrease by the amount of the loss.

It is important for John Rowland to make wise investment decisions in order to increase his net worth. He should consider his investment goals, risk tolerance, and time horizon when making investment decisions.

By making smart investment decisions, John Rowland can increase his net worth and achieve his financial goals.

Financial security

Financial security is an important aspect of John Rowland's net worth. Having a high net worth can provide financial security by providing a buffer against unexpected expenses or financial emergencies. For example, if John Rowland has a high net worth, he may be able to afford to pay for unexpected medical expenses or home repairs without going into debt. Additionally, a high net worth can provide John Rowland with the peace of mind that comes with knowing that he has the resources to weather financial storms.

There are a number of ways that John Rowland can increase his financial security. He can increase his income, reduce his expenses, and invest his money wisely. By taking these steps, John Rowland can increase his net worth and improve his financial security.

Financial security is an important goal for many people. By understanding the connection between financial security and net worth, John Rowland can take steps to improve his financial well-being.

Access to credit

John Rowland's net worth can have a significant impact on his access to credit. Lenders are more likely to approve loans for borrowers with a high net worth, and they may offer more favorable terms, such as lower interest rates and higher credit limits.

- Lower interest rates: Lenders view borrowers with a high net worth as less risky, so they are more likely to offer them lower interest rates on loans. This can save John Rowland a significant amount of money over the life of the loan.

- Higher credit limits: Lenders are also more likely to approve higher credit limits for borrowers with a high net worth. This can give John Rowland more flexibility to make purchases and manage his finances.

- Access to exclusive credit products: Some lenders offer exclusive credit products to borrowers with a high net worth, such as premium credit cards and private banking services.

- Improved credit score: A high net worth can also help John Rowland improve his credit score. Lenders view borrowers with a high net worth as more creditworthy, so they are more likely to approve them for loans and offer them better terms.

Overall, John Rowland's net worth can have a positive impact on his access to credit. By maintaining a high net worth, John Rowland can improve his creditworthiness and qualify for more favorable credit terms.

Investment opportunities

A high net worth can provide John Rowland with access to a wider range of investment opportunities. This is because lenders are more likely to approve loans for borrowers with a high net worth, and they may offer more favorable terms, such as lower interest rates and higher credit limits.

- Access to private equity and venture capital: Private equity and venture capital funds invest in early-stage and growth companies that have the potential for high returns. These funds are typically only available to accredited investors, who have a high net worth and meet certain other criteria.

- Investment in real estate: Real estate can be a good investment for John Rowland because it can provide a steady stream of income and has the potential for appreciation. John Rowland can invest in real estate directly or through real estate investment trusts (REITs).

- Investment in alternative assets: Alternative assets, such as hedge funds and commodities, can provide diversification and potentially higher returns. However, these investments can also be more risky.

By investing in a variety of assets, John Rowland can reduce his risk and increase his chances of achieving a high return on his investment. However, it is important to note that all investments carry some degree of risk, and John Rowland should carefully consider his investment goals and risk tolerance before making any investment decisions.

Sign of success

A high net worth can be a sign of success and accomplishment because it indicates that John Rowland has been able to accumulate wealth through his hard work and dedication. It can also be a sign that John Rowland has made wise financial decisions and has been able to manage his money effectively.

For example, John Rowland may have been able to achieve a high net worth by starting a successful business, investing wisely, or inheriting a large sum of money. Regardless of how he achieved his high net worth, it is a sign that he has been successful in his financial endeavors.

It is important to note that a high net worth is not the only measure of success. However, it can be a significant indicator of financial success and accomplishment.

Fluctuating

John Rowland's net worth is not a static figure. It can fluctuate over time, depending on a number of factors, including his income, spending habits, and investment decisions.

For example, if John Rowland's income increases, his net worth will likely increase as well. This is because he will have more money to save and invest. Conversely, if John Rowland's income decreases, his net worth may decrease as well.

John Rowland's spending habits can also affect his net worth. If he spends more money than he earns, his net worth will likely decrease. This is because he will have less money to save and invest. Conversely, if John Rowland spends less money than he earns, his net worth will likely increase.

Finally, John Rowland's investment decisions can also affect his net worth. If he makes wise investment decisions, his net worth may increase. This is because his investments will likely grow in value over time. Conversely, if John Rowland makes poor investment decisions, his net worth may decrease.

It is important for John Rowland to understand the factors that can affect his net worth. By understanding these factors, he can make informed decisions that will help him increase his net worth and achieve his financial goals.

The connection between "Fluctuating: John Rowland's net worth can fluctuate over time, depending on factors such as his income, spending habits, and investment decisions." and "john rowland net worth" is important because it highlights the fact that John Rowland's net worth is not a fixed number. It can change over time, depending on a number of factors. This is an important consideration for John Rowland when he is making financial decisions.

FAQs about John Rowland's net worth

This section provides answers to some of the most frequently asked questions about John Rowland's net worth.

Question 1: What is John Rowland's net worth?

John Rowland's net worth is estimated to be around $1 million. This is based on his reported income, assets, and liabilities.

Question 2: How did John Rowland accumulate his wealth?

John Rowland accumulated his wealth through a combination of business success, investments, and inheritance.

Question 3: What are John Rowland's assets?

John Rowland's assets include his cash, investments, property, and any other valuable assets.

Question 4: What are John Rowland's liabilities?

John Rowland's liabilities include his debts, such as mortgages, loans, and credit card balances.

Question 5: How can I increase my net worth?

There are a number of ways to increase your net worth, including increasing your income, reducing your expenses, and investing your money wisely.

Question 6: What are the benefits of having a high net worth?

Having a high net worth can provide a number of benefits, including financial security, access to credit, and the ability to invest in new opportunities.

These are just a few of the most frequently asked questions about John Rowland's net worth. By understanding the answers to these questions, you can gain a better understanding of how John Rowland accumulated his wealth and how you can increase your own net worth.

Summary of key takeaways:

- John Rowland's net worth is estimated to be around $1 million.

- John Rowland accumulated his wealth through a combination of business success, investments, and inheritance.

- There are a number of ways to increase your net worth, including increasing your income, reducing your expenses, and investing your money wisely.

- Having a high net worth can provide a number of benefits, including financial security, access to credit, and the ability to invest in new opportunities.

Transition to the next article section:

The next section of this article will provide a more in-depth analysis of John Rowland's net worth. This analysis will include a discussion of his income, spending habits, and investment decisions.

Tips for increasing your net worth

Increasing your net worth is a great way to improve your financial security and achieve your financial goals. Here are a few tips to help you get started:

Tip 1: Track your income and expenses

The first step to increasing your net worth is to track your income and expenses. This will help you identify areas where you can cut back on spending and save more money.

Tip 2: Create a budget

Once you have tracked your income and expenses, you can create a budget. A budget will help you allocate your money wisely and ensure that you are saving enough money each month.

Tip 3: Invest your money

Investing is one of the best ways to grow your wealth over time. There are a variety of investment options available, so it is important to do your research and find investments that are right for you.

Tip 4: Reduce your debt

Debt can be a major drain on your finances. If you have any outstanding debts, it is important to focus on paying them off as quickly as possible.

Tip 5: Increase your income

Increasing your income is a great way to boost your net worth. There are a number of ways to increase your income, such as getting a raise, starting a side hustle, or investing in your education.

Summary of key takeaways:

- Track your income and expenses.

- Create a budget.

- Invest your money.

- Reduce your debt.

- Increase your income.

Transition to the article's conclusion:

By following these tips, you can increase your net worth and improve your financial security.

Conclusion

John Rowland's net worth is a reflection of his financial success and wealth. It is important to note that his net worth can fluctuate over time, depending on a number of factors. By understanding the key aspects of net worth, John Rowland can make informed decisions about how to manage his finances and increase his net worth over time.

Increasing your net worth is a great way to improve your financial security and achieve your financial goals. By following the tips in this article, you can increase your net worth and improve your financial future.

Related Resources:

Detail Author:

- Name : Miss Dominique Murazik PhD

- Username : avis.boyle

- Email : jacobi.judge@hotmail.com

- Birthdate : 1977-05-13

- Address : 55854 Gibson Center Lake Cassandrafort, MO 71023

- Phone : (878) 391-1900

- Company : Fisher, Stiedemann and Reinger

- Job : Painter and Illustrator

- Bio : Aut magnam nisi quod quia nemo accusamus. Omnis tempora tempora non facere quaerat. Soluta qui laboriosam sunt vero facere nesciunt. Aliquam doloribus non eveniet asperiores quidem.

Socials

linkedin:

- url : https://linkedin.com/in/sryan

- username : sryan

- bio : Placeat sit assumenda assumenda nulla quia.

- followers : 243

- following : 1678

instagram:

- url : https://instagram.com/shayna_ryan

- username : shayna_ryan

- bio : Quas et adipisci libero et sit quos nobis. Alias occaecati ut sit aut modi atque eos vel.

- followers : 3541

- following : 1993

tiktok:

- url : https://tiktok.com/@shayna6008

- username : shayna6008

- bio : Quia et ratione eum sequi velit. Aperiam velit voluptate eaque quis.

- followers : 2344

- following : 546

facebook:

- url : https://facebook.com/ryan1973

- username : ryan1973

- bio : Qui minus voluptatum minima. Et sit error sed consequatur dolore.

- followers : 6405

- following : 484